Little Known Facts About Tulsa Bankruptcy Attorney.

Table of ContentsThe Of Which Type Of Bankruptcy Should You FileTop Guidelines Of Tulsa Bankruptcy Filing AssistanceBankruptcy Attorney Near Me Tulsa for DummiesGetting My Tulsa Debt Relief Attorney To WorkChapter 7 Vs Chapter 13 Bankruptcy Things To Know Before You Get ThisTulsa Bankruptcy Filing Assistance Can Be Fun For EveryoneHow Tulsa Ok Bankruptcy Specialist can Save You Time, Stress, and Money.

Ad As a daily consumer, you have 2 primary chapters of bankruptcy to choose from: Chapter 7 and Phase 13. We highly advise you first gather all your economic documents and consult with an attorney to understand which one is finest for your scenario.The clock starts on the declaring day of your previous case. If the courts disregard your bankruptcy proceeding without prejudice (definition without uncertainty of fraud), you can refile immediately or submit an activity for reconsideration. Nevertheless, if a judge rejected your case with prejudice or you voluntarily disregarded the instance, you'll have to wait 180 days before filing again.

Jennifer is likewise the writer of "Prosper! ... Affordably: Your Month-to-Month Guide to Living Your Ideal Life Without Breaking the Financial institution." Guide provides guidance, pointers, and financial administration lessons tailored toward aiding the reader emphasize staminas, identify bad moves, and take control of their finances. Jennifer's essential economic guidance to her close friends is to always have an emergency fund.

All financial obligations are not developed equivalent. Some debts acquire popular status via the legislation debts like tax obligations or youngster assistance. But some financial debts are a concern based on who is owed the financial debt. You may feel much a lot more obliged to pay a family members participant you owe cash to or to pay the doctor that brought you back to health.

What Does Tulsa Bankruptcy Legal Services Mean?

And due to this lots of people will certainly tell me that they do not desire to consist of specific debts in their insolvency instance. It is totally easy to understand, but there are two troubles with this. You are required to divulge all of your debts to the insolvency court even those financial obligations that don't disappear (like child assistance) and those financial debts you feel ethically obliged to pay.

Even though you might have the ideal purposes on paying back a certain financial obligation after bankruptcy, life takes place. I don't question that you had honorable intents when you sustained all of your debts. Nonetheless, the situations of life have led you to bankruptcy due to the fact that you couldn't pay your debts. So, although you desire to pay all of your financial debts, sometimes it doesn't function out this way.

Additionally, while your insolvency discharge will certainly get rid of any type of lawful commitments to pay your financial debts, you can voluntarily settle any financial obligation you pick after your bankruptcy mores than. Usually I see this in the clinical area. If you owe a doctor money and the financial debt is released in personal bankruptcy, do not be stunned when that medical professional will no longer have you as a person.

If you want those dental braces ahead off sooner or later, you will likely require to make some kind of repayment plan with the great medical professional. The option in both scenarios is to seek a new physician. To address the concern: there is no selecting and finding, you need to divulge all debts that you owe since the moment of your insolvency declaring.

3 Easy Facts About Tulsa Bankruptcy Lawyer Shown

If you owe your family cash prior to your case is filed, and you rush and pay them off and after that anticipate to file insolvency you should likewise expect that the bankruptcy court will certainly connect to your family members and attempt and obtain that cash back. And by try I mean they will sue them and make them go back to the cash (that won't make things unpleasant at all!) That it can be distributed amongst all of your lenders.

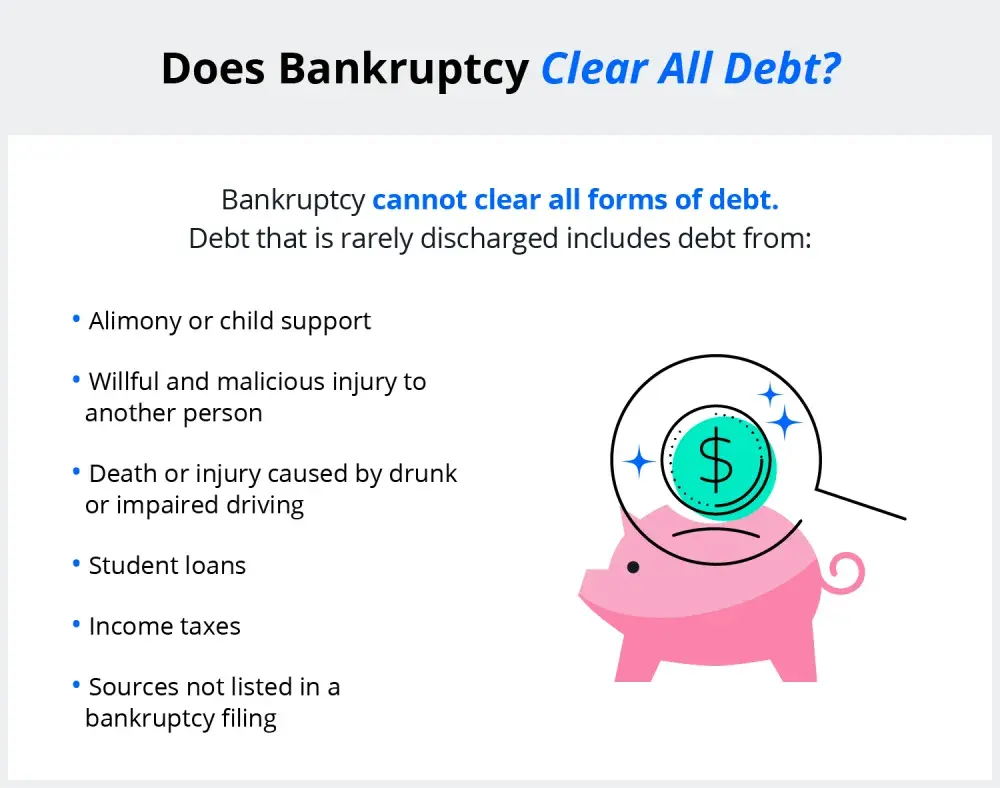

There are court declaring fees and lots of individuals hire a lawyer to navigate the intricate process., so prior to filing, it's essential that you plainly comprehend which of your financial debts will certainly be released and which will certainly continue to be.

There are court declaring fees and lots of individuals hire a lawyer to navigate the intricate process., so prior to filing, it's essential that you plainly comprehend which of your financial debts will certainly be released and which will certainly continue to be.What Does Top Tulsa Bankruptcy Lawyers Mean?

If go to this site you're wed or in a residential partnership, your personal bankruptcy filing can also affect your partner's funds, specifically if you have joint financial obligations or shared possessions. Go over the implications with your partner and think about inquiring on just how to protect their economic rate of interests. Bankruptcy should be viewed as a last resource, as the influence on your funds can be significant and lasting.

Prior to you make a decision, ask on your own these inquiries and weigh your other options. Angelica formerly held editing and enhancing functions at The Simple Dollar, Rate Of Interest, HousingWire and various other economic publications.

In 2017, there were 767,721 individual bankruptcy filingsdown from the 1.5 million filed in 2010. A number of research studies suggest that clinical financial debt is a significant reason for a number of the bankruptcies in America. Personal bankruptcy is developed for people caught in serious economic conditions. If you have too much debt, insolvency is a federal court process created to aid you remove your debts or repay them under the security of the bankruptcy court.

How Tulsa Bankruptcy Consultation can Save You Time, Stress, and Money.

The definition of a borrower that might file personal bankruptcy can be discovered in the Insolvency Code. Efforts to control your investing have fallen short, even after visiting a credit scores therapist or attempting to stick to a debt consolidation plan. You are unable to fulfill financial debt commitments on your current revenue. Your efforts to collaborate with financial institutions to establish a financial debt settlement strategy have not functioned (bankruptcy lawyer Tulsa).

The definition of a borrower that might file personal bankruptcy can be discovered in the Insolvency Code. Efforts to control your investing have fallen short, even after visiting a credit scores therapist or attempting to stick to a debt consolidation plan. You are unable to fulfill financial debt commitments on your current revenue. Your efforts to collaborate with financial institutions to establish a financial debt settlement strategy have not functioned (bankruptcy lawyer Tulsa).There are court declaring costs and many individuals employ a lawyer to navigate the intricate procedure. You need to make certain that you can manage these prices or explore choices for charge waivers if you certify. Not all financial obligations are dischargeable in insolvency, so before declaring, it is essential that you clearly comprehend which of your debts will certainly be discharged and which will stay.

How Tulsa Ok Bankruptcy Attorney can Save You Time, Stress, and Money.

If you're married or in a domestic collaboration, your personal bankruptcy filing could likewise influence your companion's financial resources, specifically if you have joint financial debts or shared properties. Discuss Get the facts the ramifications with your companion and think about seeking suggestions on exactly how to safeguard their economic passions. Personal bankruptcy ought to be considered as a last option, as the influence on your financial resources can be substantial and long-lasting.

So prior to you make a choice, ask yourself these inquiries and evaluate your other alternatives. This way, you're much better prepared to make an informed choice. Angelica Leicht is elderly editor for Managing Your Money, where she writes and edits short articles on a series of personal finance topics. Angelica previously held editing duties at The Simple Buck, Interest, HousingWire and various other economic magazines.

The smart Trick of Bankruptcy Attorney Tulsa That Nobody is Talking About

A number of researches suggest that clinical financial debt is a considerable reason of numerous of the insolvencies in America. If you have excessive financial debt, insolvency is a government court procedure developed to help you remove your debts or settle them under the security of the insolvency court.

Attempts to regulate your investing have actually failed, even after seeing a credit score therapist or attempting to stick to a debt combination plan. Your attempts to function with lenders to establish up a financial debt payment strategy have actually not worked.